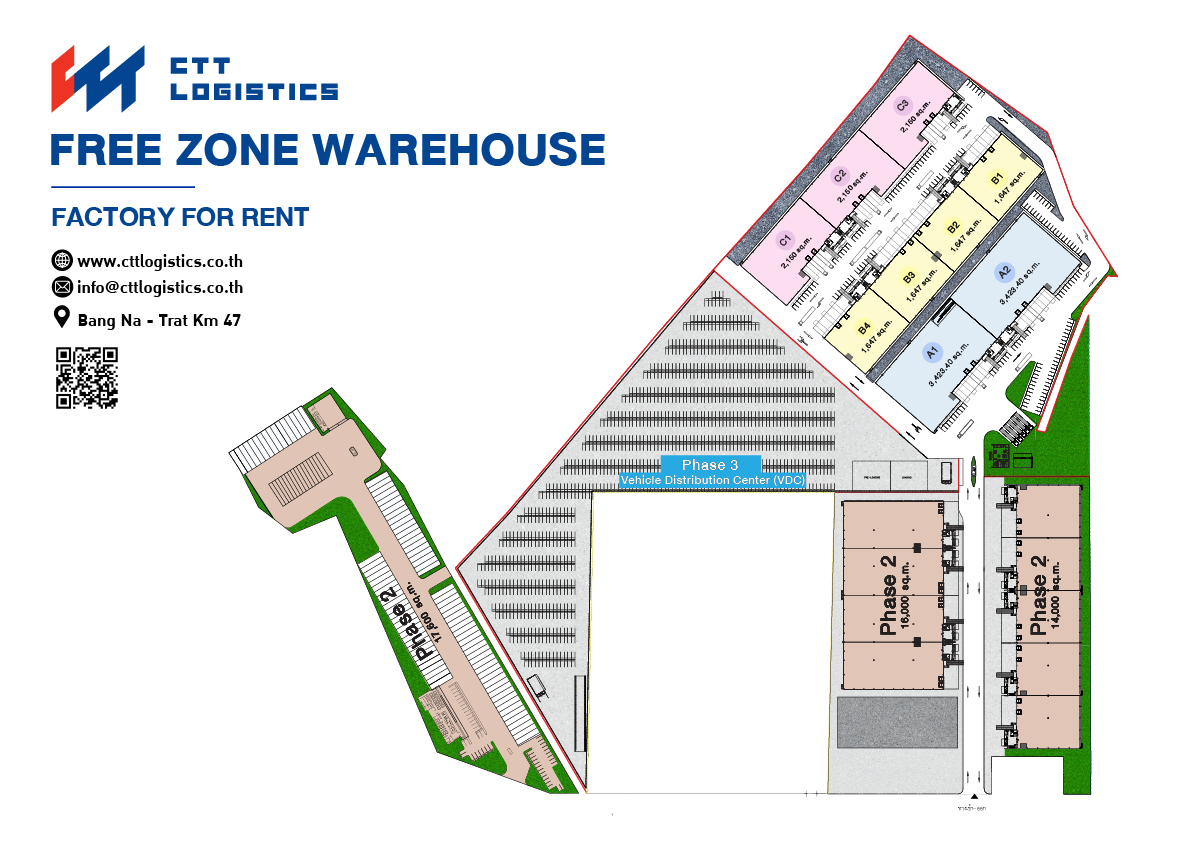

Tariff-free CTT free zone

Tariff-free CTT free zone ตั้งอยู่เลขที่ 61/6 หมู่ 13 ตำบลบางปะกง อำเภอบางปะกง จังหวัดฉะเชิงเทรา ถนนบางนา-ตราด กม. 47 และอยู่ในEastern Economic Corridor (EEC) มีทำเลที่ตั้งใกล้ศูนย์กลางโลจิสติกส์ที่สำคัญ ทั้งสนามบินระหว่างประเทศ ท่าเรือ และเชื่อมผ่านเส้นทางถนนสายหลัก ดังนี้

Distance from Airport and Port

81 กม. from Don Mueang Airport

44 กม. from Suvarnabhumi Airport

60 กม. from Bangkok Port

49 กม. จาก ICD ลาดกระบัง

63 กม. from Laem Chabang Port

Tariff-free Set-up License

CTT Logistics, Co. Ltd. received approval to set-up

Tariff-free CTT free zone

according to license No. 19/2565 on 17 August 2022 issued by the Customs Department, for conducting business for industrial and commercial purposes

Products and services

Approval of businesses

with targeted industries of factories that are in the services sector

- Land plots for long and short term lease

- Factories and Built-to-Suit warehouses for rent, customized according to client’s needs)

Privileges of tariff-free zone

Privileges of tariff-free zone in Eastern Economic Corridor (EEC) as follows:

- *Exemption of import license

- Exemption of taxes and tariffs on goods imported from abroad for at least two years

- Tax and tariff exemption for transfer of machinery and raw materials from CTT freezone warehouse to factories which receive other tax incentives, for instance factories in the freezone, factories operating in the tax-free zone, factories supported by the Board of Investment of Thailand (BOI), and bonded warehouses

- Request for tax rebate is possiblein cases where legally stipulated upon export

- Cutting of stocks for leftover materials or production waste in cases where legally stipulated upon manufacturing for export abroad only

- Able to purchase raw materials in Thailand with 0% value added tax for mixing, assembly, packaging, and separate packaging in the CTT freezone warehouse for export